According to the section 139AA of Income Tax Act, it is mandatory to both Aadhaar and pan card link by 31st December 2025 for most of resident individuals in India. In this article we will disucss every this about aadhaar and pan card linking process and how to check the status if both are already linked or not.

If you want uninterrupted access to essential financial and tax services then it is very requirement to immediately link both pan card and aadhaar card. To ensure that you do not miss the deadline, we will show you how to check the status if your aadhaar card and pan card are linked, and if they are not linked, we will show the process to link them.

How to check aadhaar and pan card linked?

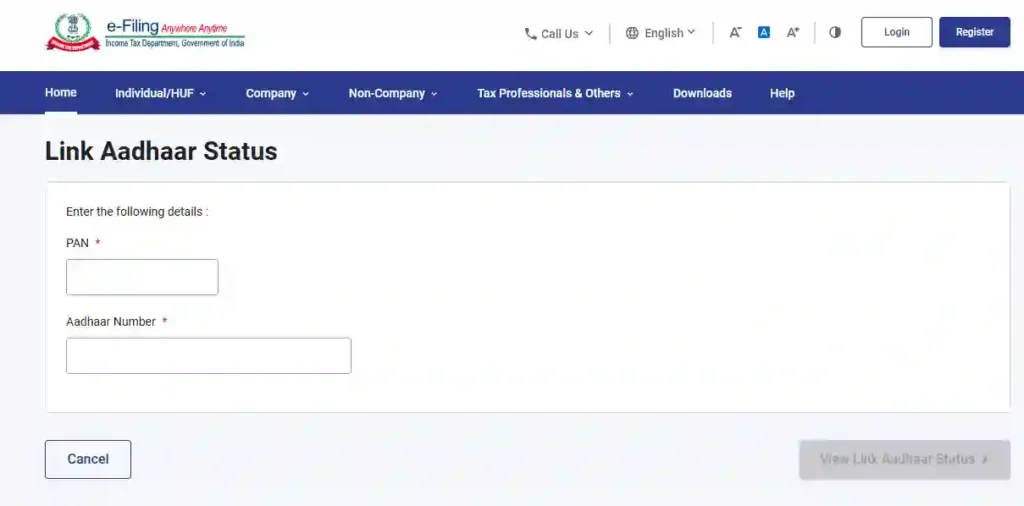

To check that our pan card and aadhar card are linked, we need to go to this website and after going that we need to fill up pan card and Aadhaar card and press the “view link aadhar status” button. check the image below:

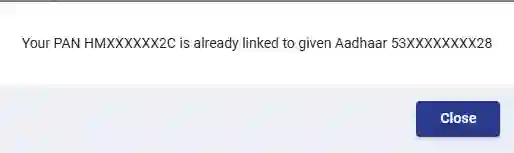

If your aadhaar and pan card are linked then the below image status will be shown:

How to Link Aadhaar and Pan Card Online

There are two online methods to link your aadhaar card with pan card. And every method can be done from your home.

READ ALSO: 8th Pay Commission

1. Through Income Tax Portal

It is the mostly used method. You need to visit the incometax.gov.in and click “Link Aadhaar” in the Quick Links and this “Link Aadhaar” menu is 3rd from the bottom in the list. And this process doesn’t require to login.

Enter the your pan card number in the pan card box and enter your aadhaar card number (12 digit) in the aadhaar card box and press the “Validate” button. An otp will be sent to the mobile number connected to your aadhaar card and enter the otp to confirm. If you will enter right otp, you will receive immediate confirmation of both linked.

2. Link via SMS

This method is the easiest one according to Rodka. Because all you need to have your registered mobile number with you. Just send an sms from your registered mobile number to 567678 or 56161 and the sms body should be “UIDPAN [12-digit-aadhar-number] [10-digit-pan-number]”. Let’s take an example:

If you Aadhaar number and Pan card number are following:

Aadhaar Number: 535251512895

Pan Number: HMNKP6250A

Then the message will be:

UIDPAN 535251512895 HMNKP6250A

After the successful message, you will receive a confirmation message in few minutes. You can go to Link Aadhaar Status option in Quick Link on hte Income Tax e-filling website to check the realtime status of your aadhaar and pan card linkage.

Non Compliance

If you failed to link your aadhaar with pan card by 31st December 2025 there will an penality as following:

If your Aadhaar enrolment is before October 1, 2024 and you got pan card by such aadhar then the deadline is 31st December 2025 and you don’t need to pay any penality but other than them who missed the earlier deadline, they much pay Rs 1000 before linking aadhaar to pan card.

If anyone still misses 31st December 2025 deadline and found doing financial transaction on an inoperative PAN card then there is a provision of Rs 10000 penality in Section 272B.

Non Compliance leads to following actions:

Higher Taxes: You’ll face much higher TDS (Tax Deducted at Source) and TCS rates.

Banking Blocks: You won’t be able to open new bank accounts or fixed deposits.

No Refunds: Any pending income tax refunds will be stuck.

Stock Market Woes: You won’t be able to invest in mutual funds or trade in the stock market.

Who is Exempt from aadhaar and pan card linkage?

Not everyone is legally required to link aadhaar and pan card. You are exempt if:

- You are an NRI (Non-Resident Indian).

- You are not a citizen of India.

- You are aged 80 years or older.

- You reside in Assam, Jammu & Kashmir, or Meghalaya.

FAQ on Aadhaar and Pan card link

1. is Aadhaar and Pan card linking mandatory?

Yes, it is mandatory to mostly taxpayers by 31st December 2025 but some got exemption also.

2. is there any penality of non linkage?

Yes, there is an penality from Rs 1000 to Rs 10000 according to non compliance.

3. is mobile number should be connected to aadhaar card?

Yes, before the aadhaar and pan card linkage, your mobile number should be linked to the aadhaar card.

4. How much time it takes to link aadhaar with pan ?

It takes less than 5 minutes if your mobile number is connected to aadhaar card.

5. What will happen if i don’t link aadhaar and pan?

Your PAN card will become inoperative from 1st January 2026 and you can avail tax services in india. It can attract a penality upto Rs 10000 also if you fail aadhaar and pan card linkage.